In the summer of 2025, a piece of news shook the global industrial chain: China's rare earth exports in July soared to 5,994 tons, a year-on-year increase of 21%, setting a new record high since the implementation of export control this year. Behind this figure lies the technological competition among China, the United States, Japan and Europe, the rapid advancement of the new energy revolution, and more importantly, the strategic code of China's transformation from "resource export" to "technology export".

I. Who is buying China's rare earths? Japan takes the lion's share, while the US is in a rush to replenish its stock.

When looking at the export map of China's rare earth resources, Japan is undoubtedly the "top buyer". In the first half of 2025, Japan's import ratio of Chinese rare earth metals and alloys reached as high as 58.3%, meaning that for every 10 tons of rare earth, 6 tons flowed to Japan. These rare earths were processed into electric motor components for new energy vehicles, joints for industrial robots, and high-end sensors, supporting the global expansion of giants like Toyota and Fanuc.

The presence of the United States is also notable. Although California has rare earth mines, 80% of the rare earth concentrate in the US needs to be transported to China for processing into magnets - just like transporting wheat to China to be ground into flour and then transported back to make bread. In June 2025, China's exports of rare earth magnets to the US suddenly increased by 660% to 353 tons. The main reason was that after the US and China reached a trade agreement, the backlog of orders that had accumulated for half a year were released all at once. More importantly, the "suspension period" for US tariffs on China will expire in August, and downstream enterprises, in order to avoid risks, began to stockpile in advance. Countries such as South Korea and Vietnam also accelerated their imports simultaneously, leading to a regional buying frenzy.

The roles of the Netherlands and Taiwan region are more like "middlemen". 26.4% of the rare earth compounds imported by the Netherlands are resold to European car manufacturers, while Taiwan region processes 16.6% of the rare earth into precision electronic components, which eventually flow to tech giants such as Apple and Tesla. This "China - middleman - end enterprise" chain makes rare earth a "hidden blood" in the global industrial chain.

II. Why did China suddenly increase its rare earth production? Policy relaxation + soaring demand.

In April 2025, China imposed export restrictions on seven types of medium and heavy rare earths, resulting in a 82% drop in magnet exports to the United States in April and May. However, just two months later, the export volume rebounded strongly. This was due to the interaction of three forces:

The first force is the "precise relaxation" of policy adjustments. In June, the Ministry of Commerce of China accelerated the approval process and gave priority to granting licenses to European car manufacturers and Vietnamese factories, but still strictly restricted American military enterprises. For instance, after German Volkswagen obtained some supplies of rare earth magnetic materials, its production line was able to resume; while the production line of the US F-35 fighter jet was still at risk of stalling due to the lack of samarium-cobalt magnets. This "differentiation strategy" not only alleviated international pressure but also targeted at the Achilles heel of the US military industry.

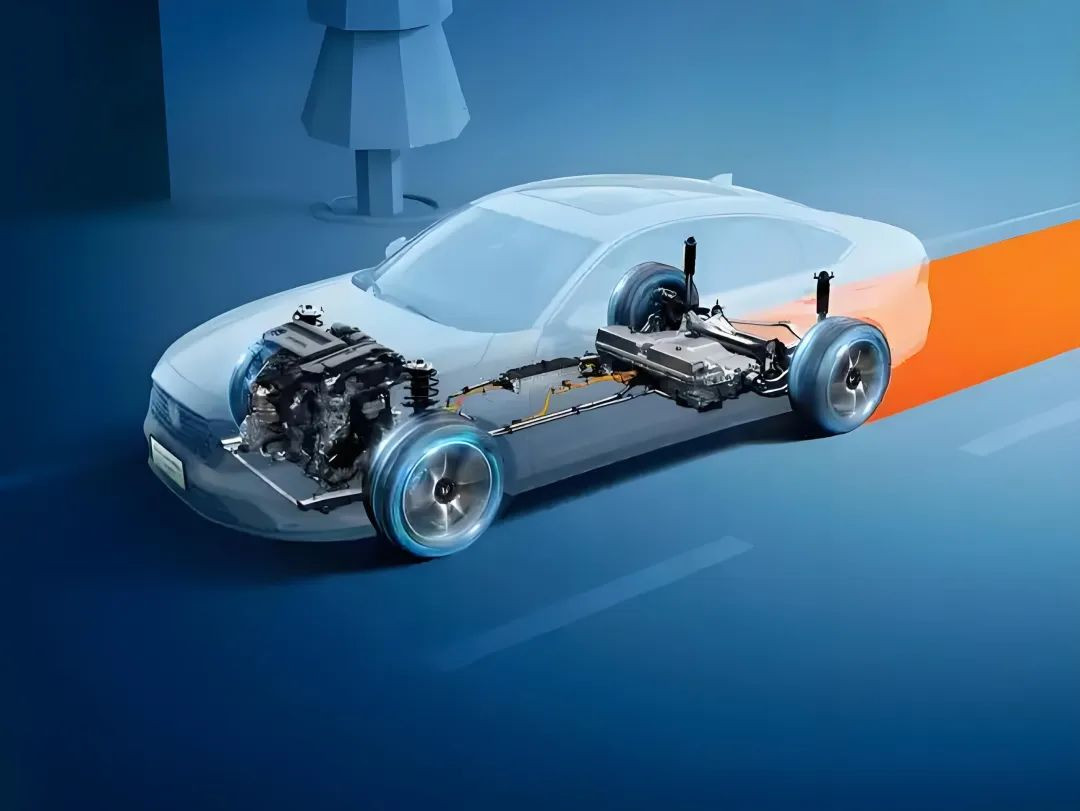

The second driving force is the "rigid demand" of the global new energy revolution. By 2025, global sales of new energy vehicles will exceed 30 million units, and each vehicle will require 2-5 kilograms of rare earth magnets; the installed capacity of wind power will increase by 40% year-on-year, and each permanent magnet wind turbine will consume 1 ton of rare earth oxides. 80% of the light rare earths (praseodymium and neodymium) exported by China directly go to these fields. Just as the workers at the Baiyunbo mine in Inner Mongolia said: "What we dig is not soil, but the key to the future world."

The third force is the "rush-start effect" of geopolitics. The tariff suspension period for the United States on China is coming to an end. Companies are taking advantage of this opportunity to avoid the additional tariffs of 10% to 25%, and are placing orders and stocking up in advance. Even companies like LG Chem from South Korea and Sumitomo Electric from Japan have even arranged charter flights to transport rare earth materials, fearing that they might miss the "last train". This panic-driven purchasing has further pushed up the short-term export volume.

III. The Paradox of Quantity Increase and Price Decrease: China is Playing a Major Strategy.

Strangely enough, while the export volume soared, the price of rare earths was falling. From January to July 2025, China's export revenue of rare earths decreased by 23.3% compared to the previous year, creating a strange cycle of "increased volume but decreased price". This is the deeper meaning behind China's strategic transformation:

In the short term, China has relaxed its restrictions on civilian rare earth exports in exchange for maintaining global supply chain stability. After European car manufacturers and Vietnamese factories obtain rare earths, they can continue production and avoid layoffs, thereby indirectly reducing trade accusations against China. Meanwhile, China still strictly controls military rare earths (such as samarium-cobalt magnets) to ensure that strategic resources are not used against itself.

In the long run, China is shifting from "selling raw materials" to "selling technology". Enterprises such as Northern Rare Earths are no longer content with exporting raw materials. Instead, they directly export neodymium-iron-boron magnetic powder to Europe and rare earth catalysts to Japan. In 2024, the export profits of high value-added products from Northern Rare Earths increased by 40%, proving that "technology export" is more profitable than "resource export". Just as the report of the Baotou Municipal Government states: "We want to let rare earths carry Chinese technology to the world."

IV. The Rare Earth War Is Far From Over: What Weapons Does China Have at Its Disposal?

Although the export volume has reached a new high, China's control over rare earths is still strengthening. 90% of the global processing of rare earth concentrate relies on Chinese technology. The civil war in Myanmar has led to a 70% reduction in the supply of medium and heavy rare earths. The US company MP Materials stopped exporting rare earth concentrate to China, which instead made domestic enterprises more dependent on local resources. More importantly, China is establishing a rare earth futures market, and in the future, it will control the price of rare earths just as it does with oil pricing.

The "rare earth export boom" in 2025 is essentially a strategic game of "retreating to advance" by China in the global industrial chain. When Japanese car manufacturers use Chinese rare earths to manufacture electric motors, and when American missiles rely on processed magnets from China, this non-violent war has already determined the outcome.

Scan to wechat :